Books and other Resources to help along the way…

Money

Explore the vital connection between finance and wellbeing. This curated selection of books delves into how effective money management can significantly impact your mental health and life quality. We emphasize the importance of financial literacy not just for wealth accumulation, but as a crucial tool for reducing stress and enhancing life satisfaction. This section also highlights ethical and responsible business practices, showcasing their role in fostering personal and societal wellbeing. Join us in discovering how mastering the world of finance can lead to a more secure, peaceful, and fulfilling life.

Four Thousand Weeks: Time Management for Mortals

by Oliver Burkeman

#Time is not money #Life

Drawing on the insights of both ancient and contemporary philosophers, psychologists, and spiritual teachers, Oliver Burkeman delivers an entertaining, humorous, practical, and ultimately profound guide to time and time management. Rejecting the futile modern fixation on “getting everything done,” Four Thousand Weeks introduces listeners to tools for constructing a meaningful life by embracing finitude, showing how many of the unhelpful ways we’ve come to think about time aren’t inescapable, unchanging truths, but choices we’ve made as individuals and as a society - and that we could do things differently.

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

by Morgan Housel

#PersonalFinance #TopChoice

Morgan Housel offers a unique and insightful exploration into how our behaviors and perceptions shape our financial decisions. Housel moves beyond the typical numbers and strategies found in conventional finance books, delving into the psychological, emotional, and cultural influences that impact our relationship with money. Through a series of short stories and real-life examples, he illustrates the often-surprising ways our thoughts and feelings about money influence our spending, saving, and investing habits. This book doesn’t just offer financial advice; it provides a deeper understanding of why we make the financial decisions we do and how to make better choices by being more mindful of our psychological biases. "The Psychology of Money" is an essential read for anyone looking to gain a more profound, behavior-focused perspective on personal finance and investing.

Thinking in Bets

by Annie Duke

#Probability #Decision Making

Even the best decision doesn't yield the best outcome every time. There's always an element of luck that you can't control, and there's always information hidden from view. So the key to long-term success (and avoiding worrying yourself to death) is to think in bets:

Profit First

by Mike Michalowicz

#Cash Flow #Top Choice #Business Foundations

Conventional accounting uses the logical (albeit, flawed) formula: Sales - Expenses = Profit. The problem is, businesses are run by humans, and humans aren't always logical. Serial entrepreneur Mike Michalowicz has developed a behavioral approach to accounting to flip the formula: Sales - Profit = Expenses. Just as the most effective weight loss strategy is to limit portions by using smaller plates, Michalowicz shows that by taking profit first and apportioning only what remains for expenses, entrepreneurs will transform their businesses from cash-eating monsters to profitable cash cows.

Richest Man in Babylon

by George S. Clason

#Foundations of Personal Finance

Overall, "The Richest Man in Babylon" is a timeless and accessible guide to personal finance. Its lessons are conveyed through engaging and memorable stories, making it an enjoyable read for anyone interested in improving their financial situation. Some keywords in the book include saving, compound interest, advice, investing, diversification, risks, and patience.

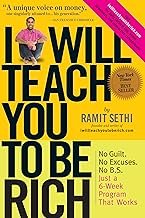

I Will Teach You To Be Rich

by Ramit Sethi

#Foundations of Personal Finance

At last, for a generation that's materially ambitious yet financially clueless comes I Will Teach You To Be Rich, Ramit Sethi's 6-week personal finance program for 20-to-35-year-olds. A completely practical approach delivered with a nonjudgmental style that makes readers want to do what Sethi says, it is based around the four pillars of personal finance- banking, saving, budgeting, and investing-and the wealth-building ideas of personal entrepreneurship.

You Need a Budget

by Jesse Mecham

#PersonalFinance

Mecham introduces an accessible, effective budgeting method based on four key rules: giving every dollar a job, embracing true expenses, adjusting to changing financial situations, and aging your money. This book underscores the deep connection between financial stability and mental well-being. Learning to manage cash flow effectively reduces stress and anxiety, leading to a more peaceful and controlled financial life. This stability not only benefits one’s mental health but also positively influences relationships, as financial harmony is often key to healthier, stress-free interactions with loved ones. Mecham's approach is not just about managing finances; it's about improving overall life quality by establishing a more thoughtful and purposeful relationship with money.

Affiliate Disclosure:

All of the links on this page are affiliate links, which means I may earn a commission if you click through and make a purchase. As an Amazon Associate, I earn from qualifying purchases. This commission comes at no additional cost to you and helps support my work. Thank you for your support!